Operating Margin: What It Is and the Formula for Calculating It, With Examples

Онлайн casino 888 казино Онлайн Играйте в бесплатную пробную версию

مارس 15, 2024Способ играть russanews.ru в казино онлайн

مارس 15, 2024Operating Margin: What It Is and the Formula for Calculating It, With Examples

While that measure is typically used for liquidity purposes, it is useful to see how various ratios can be used in different ways. This means that the firm completely sells its inventory about 4 times during the period. Some industries, like grocery stores, have a very high turnover, while others, like a Bentley dealership, will have very low turnover ratios. Therefore, it is crucial to understand what industry is being looked at, and what the average for that industry is.

What is the revenue ratio?

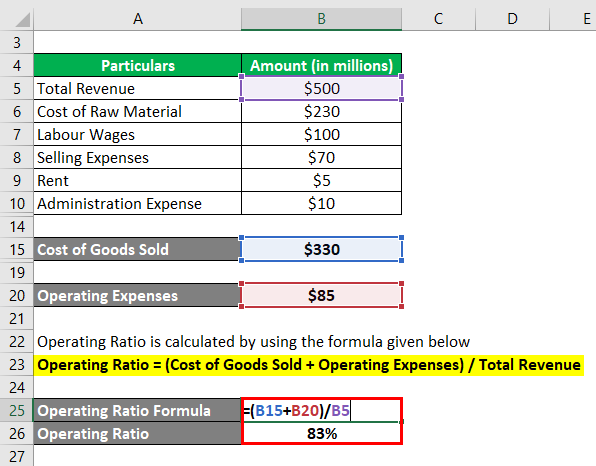

A higher operating ratio is always harmful because a small margin is left for interest, income tax, dividends, and reserves. Operating margin takes into account all operating costs but excludes any non-operating costs. Net profit margin takes into account all costs involved in a sale, making it the most comprehensive and conservative measure of profitability. Gross margin, on the other hand, simply looks at the costs of goods sold (COGS) and ignores things such as overhead, fixed costs, interest expenses, and taxes. When a company’s operating margin exceeds the average for its industry, it is said to have a competitive advantage, meaning it is more successful than other companies that have similar operations. While the average margin for different industries varies widely, businesses can gain a competitive advantage in general by increasing sales or reducing expenses—or both.

What are the main income statement ratios?

However, investors should be cautious of abnormally low operating ratios. Sometimes, high profitability reflects unsustainably low expenses in areas like R&D, maintenance, wages, or marketing, which hurts long-term competitiveness. The operating ratio shows the efficiency of a company’s management by comparing the total operating expense of a company to net sales. The smaller the ratio, the more efficient the company is at generating revenue versus total expenses. It helps the management and analysts understand if the company is efficient enough to manage all of its expenses against its total turnover. Aggressive expansion efforts also lead to an operating ratio of over 100%.

How do operating income and revenue differ?

Operating ratios indicate how strategic moves like acquisitions, expansions, marketing initiatives, and product introductions affect efficiency. Analysts look for ratios returning to normalized levels after initial impacts subside. Companies must clearly state which expenses are operational and which are designated for other uses. When you’re in the weeds of running your business each day, it can be difficult to zoom out and see how well your company is performing. Seasonal dips and peaks in demand may make it seem like you’re doing better (or worse) than you are.

Would you prefer to work with a financial professional remotely or in-person?

- Net profit margin takes into account all costs involved in a sale, making it the most comprehensive and conservative measure of profitability.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- The operating Ratio gives investors a clear picture of the company’s core profitability.

- Finally, as with all ratios, it should be used as part of a full ratio analysis, rather than in isolation.

A higher ratio indicates that a firm is efficient at converting assets to revenue. However, since both current and long-term assets are included in the measure, it can be difficult to interpret. Operating expenses are essentially all expenses except taxes and interest payments. Also, companies will typically not include non-operating expenses in the reporting farming income on schedule f. This usually translates to paying high interest expenses, which are never included in the figures used to work out the operating ratio. Two organizations may report similar operating ratios, but have significantly different amounts of debt.

An operating ratio of 100% means revenues exactly equal operating expenses – the company is at breakeven. By comparing EBIT to sales, operating profit margins show how successful a company’s management has been at generating income from the operation of the business. There are several other margin calculations that businesses and analysts can employ to get slightly different insights into a firm’s profitability.

The trend shows whether the company’s operational efficiency is improving or deteriorating. Investors compare the efficiency and profitability of companies in the same industry by analyzing their operating ratios, with lower ratios indicating greater operational efficiency and stronger profit potential. The operating ratio is only useful for seeing if the core business is able to generate a profit. Since several potentially significant expenses are not included, it is not a good indicator of the overall performance of a business, and so can be misleading when used without any other performance metrics.

However, it is possible for a company’s operating Ratio to exceed 100%. This occurs when operating expenses are greater than net sales revenue over a given period. There are five scenarios where an operating ratio over 100% arises for a public company whose stock is traded on exchanges.

The Ratio alone does not capture important qualitative factors about a business. As profits expand due to the leverage from a declining operating ratio, the company often exceeds earnings targets and analyst expectations. This consistent earnings outperformance tends to make the stock more attractive to investors.

The stock market has eight important considerations to make when assessing the operating Ratio. First and foremost is profitability, as measured by metrics like the operating margin. Investors want to see that the company is efficiently generating earnings from its core business operations. However, maximizing profitability often requires tradeoffs that degrade quality or sustainability. A company’s operating margin, sometimes referred to as return on sales (ROS), is a good indicator of how well it is being managed and how efficient it is at generating profits from sales. It shows the proportion of revenues that are available to cover non-operating costs, such as paying interest, which is why investors and lenders pay close attention to it.