Accounting Equation: What It Is and How You Calculate It

Alcohol and sickness: Intolerance signs, causes, and aging

فبراير 3, 2021Брокер AMarkets: реальные отзывы клиентов 2024 на ForexTarget

فبراير 9, 2021Accounting Equation: What It Is and How You Calculate It

You can witness the easy implementation of the tool and try it out to get a renewed experience while handling your accounting system. A single interface gives you access to all remarkable features, including the ability to add products, services, and inventory.

- Often, a company may depreciate capital assets in 5–7 years, meaning that the assets will show on the books as less than their “real” value, or what they would be worth on the secondary market.

- The accounting equation is not always accurate if it is unbalanced.

- This equation should be supported by the information on a company’s balance sheet.

- It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities.

- For another example, consider the balance sheet for Apple, Inc., as published in the company’s quarterly report on July 28, 2021.

Shareholders’ Equity

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Great! The Financial Professional Will Get Back To You Soon.

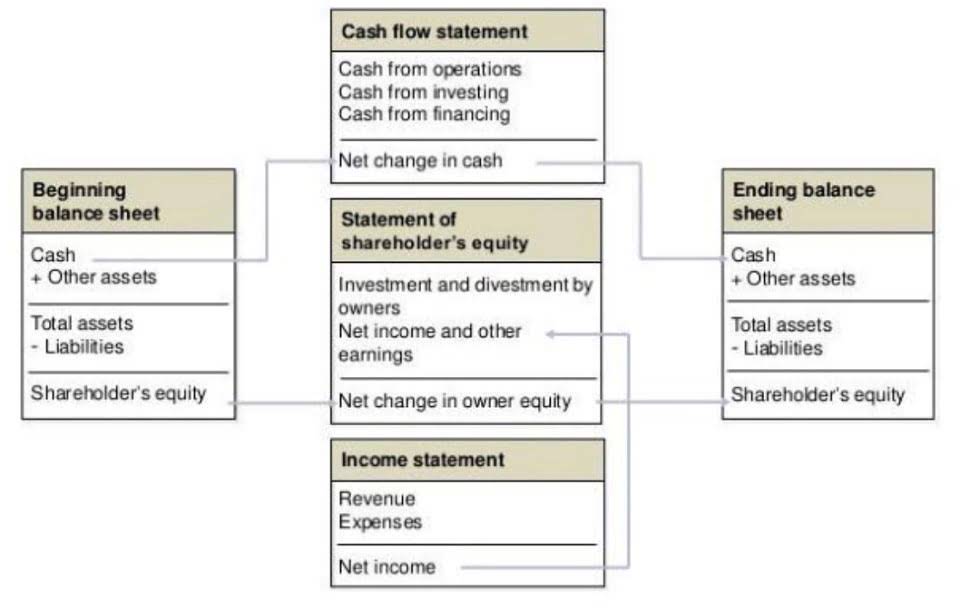

It will always be true as long as all transactions are appropriately accounted for and can never fail or be out of balance for any given entity. It can also cause problems with taxes and audits, as well as customers who may suspect fraud or mishandling of funds as a result of an unbalanced equation. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. This https://www.bookstime.com/ formulation gives you a full visual representation of the relationship between the business’ main accounts.

Extended Version of The Accounting Equation

On 10 January, Sam Enterprises payroll sells merchandise for $10,000 cash and earns a profit of $1,000. As a result of this transaction, an asset (i.e., cash) increases by $10,000 while another asset ( i.e., merchandise) decreases by $9,000 (the original cost). The accounting equation will always remain in balance if the double entry system of accounting is followed accurately.

He is the sole author of all the materials on AccountingCoach.com. The 500 year-old accounting system where every transaction is recorded into at least two accounts. Parts 2 – 6 illustrate transactions involving a sole proprietorship.Parts 7 – 10 illustrate almost identical transactions as they would take place in a corporation.Click here to skip to Part 7.

Real-World Examples of the Expanded Accounting Equation

Contributed capital and dividends show the effect of transactions with the stockholders. The difference between the revenue and profit generated and expenses and losses incurred reflects the effect of net income (NI) on stockholders’ equity. Overall, then, the expanded accounting equation is useful in identifying at a basic level how stockholders’ equity in a firm changes from period to period.

Assets in Accounting: A Beginners’ Guide

- Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- This equation holds true for all business activities and transactions.

- We also show how the same transaction affects specific accounts by providing the journal entry that is used to record the transaction in the company’s general ledger.

- This transaction would reduce cash by $9,500 and accounts payable by $10,000.

- Some assets are tangible like cash while others are theoretical or intangible like goodwill or copyrights.

- This formulation gives you a full visual representation of the relationship between the business’ main accounts.

If it’s financed through debt, it’ll show as a liability, fundamental accounting equation but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. Substituting for the appropriate terms of the expanded accounting equation, these figures add up to the total declared assets for Apple, Inc., which are worth $329,840 million U.S. dollars. Assets pertain to the things that the business owns that have monetary value. Examples of assets include, but are not limited to, cash, equipment, and accounts receivable.

Company worth

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. To learn more about the balance sheet, see our Balance Sheet Outline. Unearned revenue from the money you have yet to receive for services or products that you have not yet delivered is considered a liability. The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof.

Double-entry bookkeeping is a system that records transactions and their effects into journal entries, by debiting one account and crediting another. Although Coca-Cola and your local fitness center may be as different as chalk and cheese, they do have one thing in common – and that’s their accounting equation. Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense. As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings). Therefore cash (asset) will reduce by $60 to pay the interest (expense) of $60.