Returns Inwards or Sales Returns Definition & Journal Entries

Individual Taxpayer Identification Numbers ITIN

ديسمبر 3, 2020Oil and Gas Accounting Training

يناير 25, 2021Returns Inwards or Sales Returns Definition & Journal Entries

When merchandise is returned, customers usually ask for a cash refund. However, a customer may find that low-quality (or slightly damaged) goods can be resold at a lower price or they can be used elsewhere. These accounts normally have credit balances that are increased with a credit entry.

How to Record a Sales Revenue Journal Entry

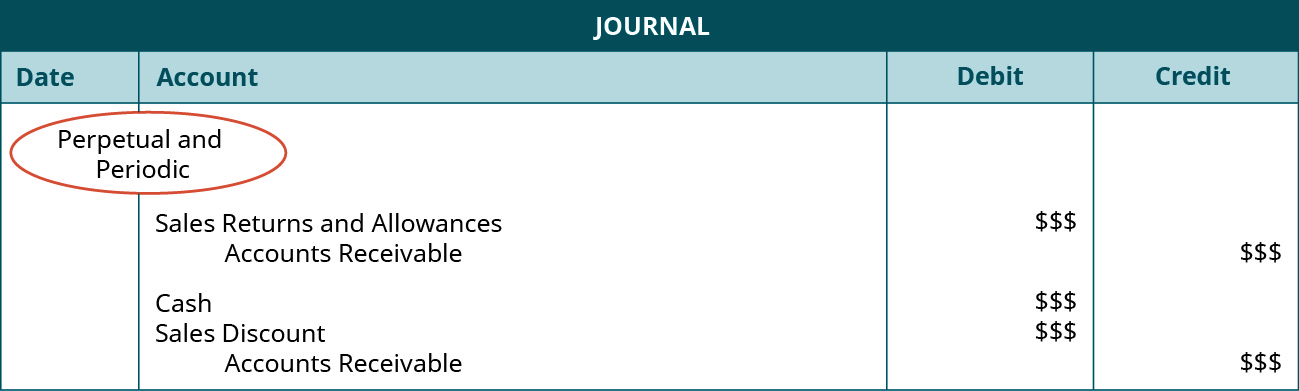

The account, therefore, has a debit balance that is opposite the credit balance of the sales account. Accounting events related to goods being returned are documented in the final accounts as they have a monetary impact on the financial statements of a company. Depending on the terms and conditions of a transaction, goods sold both in cash and credit may be returned.

Give Guarantees to Customers Regarding the Quality of Goods and Services They Purchase

- Credit memo numbers are records that allow your company to track credits given for various issues.

- It is very important for the management to review the information regarding the sales return.

- The discount allowed journal entry will be treated as an expense, and it’s not accounted for as a deduction from total sales revenue.

- The company that receives the goods back must return them as sales returns.

To update your inventory, debit your Inventory account to reflect the increase in assets. And, credit your Cost of Goods Sold account to reflect the decrease in your cost of goods sold. If a customer made a cash purchase, decrease the Cash account with a credit. A purchase return, or sales return, is when a customer brings back a product they bought from a business, either for a refund or exchange. No matter how great your products are, you’re bound to have purchase returns at some point or another.

Posting Entries From Sales Returns and Allowances Journal to Ledger Accounts

The cash account is debited to reflect the increase in ABC Electronics’ cash holdings due to the sale. The sales revenue account is credited to record the income earned from selling the laptops. This transaction increases both the company’s assets (cash) and its equity (through sales revenue). In a company’s general ledger, both sales returns and sales allowances are recorded in a single account known as the sales returns and allowances account. By nature, this account is a contra revenue account, and its balance is deducted from sales revenue when the income statement is drawn.

Accounting for Sales Return: Journal Entries and Example

You might offer free returns, charge a restocking fee, accept returns only with a receipt, or not accept returns at all. Or, maybe you decide to compensate customers returning items with store credit. During the same period, ABC Co. made sales of $200,000 to another customer, RST Co. The accounting entries to record revenues from the transaction were as follows.

In exchange, the company will compensate the customers by repaying them or selling them other products. The company that receives the goods back must return them as sales returns. However, some customers found problems with their lamps and returned them. Now, Jenny must record this amount to ensure her financial statements reflect the true picture of her business. In the income statement, the SRA account is subtracted from sales to denote contra revenue. If this entry is not made, Jill’s records might wrongly reflect revenue instead of contra revenue.

To create a journal entry in your general ledger or for a sale, take the following steps. Please note that accounts receivable is credited in case of Club B because the amount was still outstanding at the time of the sales return. Customers are normally entitled to return the products they purchase from a company when they are not satisfied, usually within a specified duration after the sale. When a sales return occurs, the customer physically returns the product and receives his cash back. When a customer returns something they paid for with credit, your Accounts Receivable account decreases. Reverse the original journal entry by crediting your Accounts Receivable account.

Whenever cash is received, the asset account Cash is debited and another account will need to be credited. Since the service was performed at the same time as the cash was received, the revenue account Service Revenues is credited, thus increasing its account balance. Except for trade discounts — which are not recorded in the financial statements, these discounts appear as a credit on the income statement in the Profit and Loss Account.

Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. Sales returns and allowances are contra revenue accounts in the financial statements. how to calculate ending inventory under specific identification Usually, companies provide a breakup of the contra revenue account to calculate the net sales figure in the income statement. And the related cost of goods sold with the original amount is revised back to inventory.

However, in general, companies consider other relevant factors while determining the accounting treatment of a business transaction. Companies can track product quality, logistics and inventory management efficiency, pricing and promotion strategies, and customer satisfaction levels, among other things. To determine debit or credit entries, a company must record the refunds (total and partial) and discounts to reflect revenue reduction. However, they must also record the relevant credit entries in case of partial refunds and discounted sales. When customers accept damaged products in return for a discount on the selling price, these accounting entries are made.