What Is a Trial Balance? Everything You Need to Know 2023

“же Делать Ставки в Спорт В Букмекерских Конторах Правильно: советчиков, Стратегии Для Начинающи

ديسمبر 13, 2022Ставки на Спорт Онлайн Букмекерская Контора Betboom

ديسمبر 14, 2022What Is a Trial Balance? Everything You Need to Know 2023

Content

The first method is to recreate the t-accounts but this time to include the adjusting entries. The new balances of the individual t-accounts are then taken and listed in an adjusted trial balance. For example, let’s say that you bought $600 worth of office supplies on a personal credit card, resulting in a $600 credit excess on your unadjusted trial balance. The adjusted trial balance would correct the error by adding a $600 debit to expenses.

- Financial statements are normally prepared to refer to the trial balance; otherwise, it would turn out to be difficult.

- Furthermore, some accounts may have been used to record multiple business transactions.

- You’ll likely prepare an unadjusted, adjusted, and post-closing trial balance during the accounting cycle.

- If the totals don’t match, a missing debit or credit entry, or an error in copying over from the general ledger account may be the cause.

- There are no complexities regarding double entries here; at this stage, it has been completed.

There is no need to list down accounts in the adjusted trial balance that have a zero balance. Only those accounts that will appear on the financial statements need to be listed. There are two types of trial balance – an unadjusted trial balance and an adjusted trial balance. The difference between the two is that the unadjusted trial balance is prepared before adjusting entries and the adjusted trial balance is prepared after adjusting the entries. This is the only major difference as all the other steps required to create the trial balance are usually the same. First of all, the preparation of the Trial Balance is an essential step in the accounting cycle.

What is the Purpose of a Trial Balance in the Accounting Cycle?

A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. The debits and credits include all business transactions for a company over a certain period, including the sum of such accounts as assets, expenses, liabilities, and revenues. Creating a trial balance sheet and making sure the debit and credit columns are equal are two necessary steps toward drafting an accurate financial statement.

This balance is transferred to the Cash account in the debit column on the unadjusted trial balance. Accounts Payable ($500), Unearned Revenue ($4,000), Common Stock ($20,000) and Service Revenue ($9,500) all have credit final balances in their T-accounts. These credit balances would transfer to the credit column on the unadjusted trial balance. A post-closing trial balance enters each and every account with zero net balance on the balance sheet. It verifies whether the debit and credit balances are identical and shows them after completing the closing entries. In addition, this type of trial balance also acts as an opening trial balance for the upcoming year.

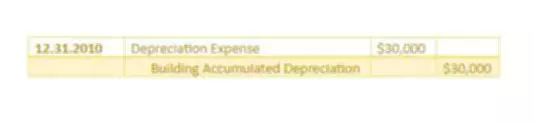

Prepare Journal Entries

If all of the accounts are correctly recorded in the balance sheet, then assets should be equal to liabilities plus equity. Same as trial balance, if total debit and credit are the same, that means the debit or credit rule probably correctly applies. A trial balance (TB) is a summary of the debits and credits of all the ledger accounts within an organization over a given period. In other words, it’s a summation of all of the financial transactions that have occurred during that stage. A trial balance is prepared after posting journal entries into the ledger and balancing the accounts.

- The purpose of the unadjusted trial balance is to test the whether debits equal the credits after the recording phase.

- A trial balance is a list of all the ledger account balances as of a certain date.

- A trial balance may contain all the major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and losses.

- For example, e-commerce sellers need to make appropriate adjustments to get an accurate balance of inventory and cost of sales.

- The totals equal $8,500 on both sides for the accounting period in question, meaning the books are balanced.

- The difference between the two is that the unadjusted trial balance is prepared before adjusting entries and the adjusted trial balance is prepared after adjusting the entries.

- If the total of the debit column does not equal the total value of the credit column then this would show that there is an error in the nominal ledger accounts.

- For example, if you acquire a new fixed assets item this transaction must be shown on the debit side of the related asset account.

Bank loans and accounts payable are liabilities, and the final six accounts are equity and expenses. “Trial” in this context means “test” or “experiment.” A trial balance is a quick reference point and it’s also a preliminary record for preparing the company’s balance sheet and income statement. what is a trial balance Not so very long ago, when accounting was calculated on paper, the trial balance played a central role in keeping tabs on the company’s financials. Now, with the adoption of accounting software into most businesses, the trial balance is not as central, but it’s still a part of the cycle.

What is the Purpose of a Trial Balance?

You can sum up the transactions using a trial balance format, making separate columns for debits and credits. The left column should show all debit balances, and the right column will show all credit balances. Essentially, recording a trial balance is the first step when preparing official financial statements.

- The sales account is totaled to show total sales of $2,125 for the month, which in effect is the credit balance taken to the trial balance.

- As you can see, a trial balance plays a key role in keeping a company’s books accurate and up-to-date.

- A trial balance functions as a checkup for an organization, to identify errors in bookkeeping, or as an indication for places to audit.

- Finally, as previously stated, a trial balance provides account summaries that are critical for putting together a balance sheet and an income statement.

- This first step entails collecting records of all of the company’s transactions, including receipts, invoices, paystubs, and bank statements.

- An accounting trial balance is for businesses that use accrual accounting.

- Debit balances are merely listed on the debit of the trial balance, with credit balances on the credit.

It serves as a check to ensure that for every transaction, a debit recorded in one ledger account has been matched with a credit in another. If the double entry has been carried out, the total of the debit balances should always equal the total of the credit balances. Furthermore, a trial balance forms the basis for the preparation of the main financial statements, the balance sheet and the profit and loss account. With modern accounting tools, credit and debit balances are checked against each other automatically, making trial balances somewhat obsolete. However, some businesses prepare trial balances as an internal check before issuing official financial statements.